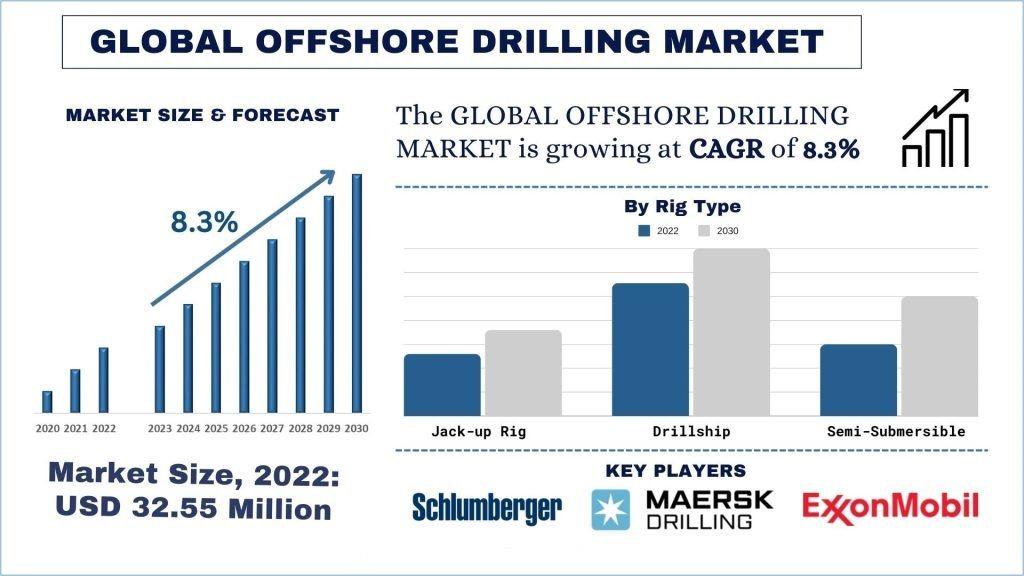

According to a new report by UnivDatos, the global Offshore Drilling Market is expected to grow at a significant rate of around 8.3% during the forecast period.

Factors Driving the North America Offshore Drilling Market

The North American region, comprising the United States, Canada, and Mexico, is witnessing a recovery in offshore drilling activities, driven by a combination of factors that include energy security considerations, technological advancements, and the vast potential of the region's offshore hydrocarbon resources.

In the United States, offshore drilling in the Gulf of Mexico has long been a crucial component of the country's energy strategy. However, the pursuit of energy independence and the desire to reduce reliance on imported oil have further fueled investments in offshore exploration and production. According to the U.S. Energy Information Administration, federal offshore areas in the Gulf of Mexico account for approximately 15% of the nation's crude oil production and 3% of its natural gas production. The Bureau of Ocean Energy Management estimates that the Gulf of Mexico holds over 48 billion barrels of undiscovered technically recoverable oil and 141 trillion cubic feet of undiscovered technically recoverable natural gas.

Access sample report (including graphs, charts, and figures)- https://univdatos.com/reports/offshore-drilling-market?popup=report-enquiry

Furthermore, technological advancements have played a crucial role in enabling offshore drilling in the North American region. The development of advanced drilling rigs, subsea production systems, and enhanced oil recovery techniques has made it possible to access and exploit resources in challenging offshore environments, including deep and ultra-deep waters, more efficiently and cost-effectively. Moreover, the North American offshore drilling market is supported by a well-developed supply chain, skilled workforce, and robust infrastructure. Major energy companies, along with specialized service providers, have a significant presence in the region, contributing to its growth and competitiveness.

In December 2023, Oil companies offered $382 million for drilling rights in the Gulf of Mexico. According to the US Department of Interior's Bureau of Ocean Energy Management, companies including Chevron, Hess, and BP offered bids on more than 300 parcels covering 7000 square km.

Factors Driving the Europe Offshore Drilling Market

The offshore drilling market in Europe has witnessed significant growth in recent years, driven by a combination of factors. Europe's objective of energy security and the need to diversify its energy mix have been the primary drivers of the region's offshore exploration and production activities. The depletion of mature onshore and shallow-water reserves has necessitated the exploration of deep-water and ultra-deep-water resources. According to the International Energy Agency (IEA), European offshore oil and gas production accounted for approximately 30% of the region's total hydrocarbon production in 2021. This figure is expected to rise as companies invest in offshore projects. The North Sea, one of the most prolific offshore regions globally, has been a major driver of Europe's offshore drilling market. The United Kingdom, Norway, and Denmark have been at the forefront of offshore exploration and production activities in the North Sea

China Region to drive the global offshore drilling market

China's offshore drilling market has experienced astonishing growth driven by its rapidly increasing energy demands, driven by its large population and economic expansion. Energy security and self-sufficiency have been the priority of China's offshore drilling initiatives. With a population of over 1.4 billion and a growing economy, China's energy consumption has soared, encouraging the country to pursue domestic offshore reserves to reduce reliance on imports actively. Moreover, exploration activities in deep and ultra-deep waters have been a critical focus for China's offshore drilling market. The country has identified capable offshore basins, such as the South China Sea and the East China Sea. Furthermore, China's offshore drilling market has benefited from favorable government policies and incentives. The Chinese government has implemented measures to encourage domestic oil and gas production, including tax incentives, subsidies, and streamlined regulatory frameworks.

For instance, China's offshore giant CNOOC aims to raise its oil and gas output to 1.95 million b/d of oil equivalent in 2024, about 5.2% higher than its estimated production of 1.85 million boe/d in 2023.

Contact Us:

Email - contact@univdatos.com

Website - www.univdatos.com