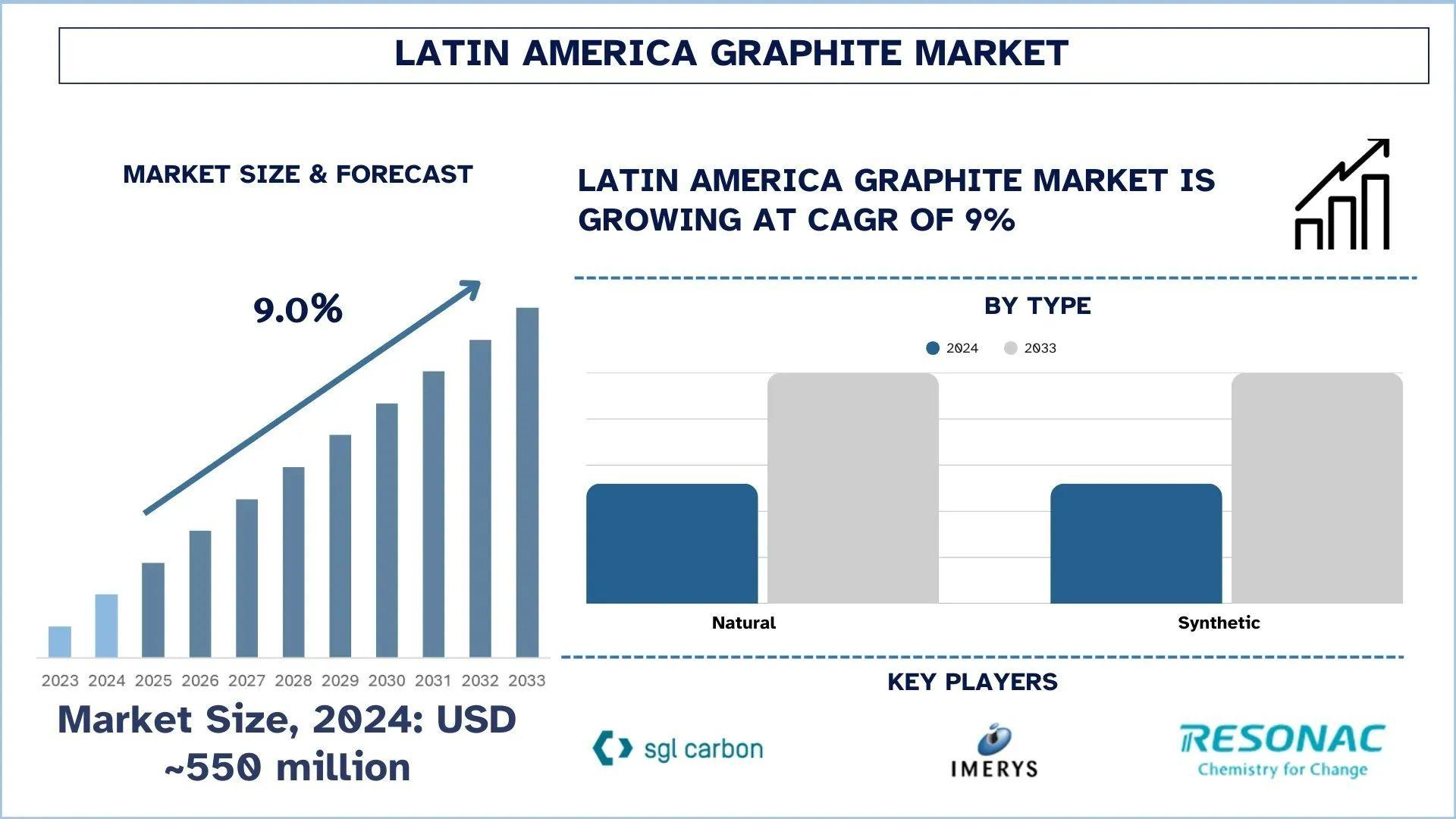

According to UnivDatos, increasing demand for energy storage systems and the rise of electric vehicles have boosted the demand for graphite in Latin America. As per their “Latin America Graphite Market” report, the Latin America market was valued at USD 550 million in 2024, growing at a CAGR of about 9% during the forecast period from 2025 - 2033 to reach USD million by 2033.

The market for graphite in Latin America is undergoing a transformative stage, driven by technological advancements, industrial applications, and shifting consumer demands. Increases in the production of electric vehicles, the storage of energy, and the infrastructure development have made graphite an essential product in various industries. There is a discernible shift towards synthetic graphite to reform the supply chains, with Brazil and Mexico playing an important role in leveling the natural and synthetic resources. Growth is further driven by increasing investments, capacity extensions, and localization efforts under the support of the regional trade agreements. In the specific case of Brazil, it is becoming a regional leader, which is supported by industrialization and new production powers.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/latin-america-graphite-market?popup=report-enquiry

Pivot toward synthetic graphite:

The market in Latin America is also slowly moving towards synthetic graphite as the electric vehicle, energy-storage, and semiconductor supply chains require anode feedstock that is dependable and spec-tight. Still of importance are natural graphite deposits in Brazil and Mexico; however, customers are currently concerned with the uniformity of purity, particle size, and low variability, which synthetic graphite provides for fast-charge, long-cycle batteries. The refineries and steelmakers in the area are upgrading their facilities to obtain needle-coke, increase the ability to graphitize, and close-loop recycling of machining scraps to make the process less expensive and less carbon-intensive. Policy incentives in connection with rules of origin of nearshoring and USMCA promote local qualification programs, reducing the use of Asian intermediaries. Between 2025 and 2028, hybrid forms will be on the table. High-performance cells and specialty refractories will require synthetic graphite, while cost-effective segments will integrate synthetic graphite with coated natural graphite to strike a balance between performance, cost, and ESG goals.

Latest Trends in the Latin America Graphite Market

Industrial & infrastructure demand:

The transition of Latin America to synthetic graphite is being enhanced by industrial and infrastructure demand. The process of decarbonizing steel plants is accelerating the use of electric-arc furnaces, which require ultra-uniform and graphitized refractories. The purity and mechanical stability of synthetic graphite deliver superior results in both cases: reducing breakage and preventing unintentional outages. Cement, glass, and non-ferrous smelters are renovating linings, slide gates, and continuous-casting components to increase the life expectancy of these assets, thereby reducing capital expenditure on highways, ports, and housing. The growth of grid expansion and renewables is introducing new requirements of thermal management, conductive additives, and stationary-storage anodes, which prefer synthetic graphite over narrower performance windows. Predictable supply and repeatable specification are compensated by public works schedules, which induce the localization of graphitization and mills to localize reclaim machining scrap and to obtain long-term contracts with needle coke. Blended solutions with synthetic graphite in areas requiring critical heat and natural graphite in other areas should be anticipated to offer companies a balance between cost, uptime, and ESG goals across projects.

Key Investment Trends:

The increasing demand in the electric vehicle (EV) and energy storage industries gives important trends of investment in the graphite market. Investors are also diverting their funds into the exploration of projects that increase their production capacity of graphite, though concentration is more directed towards the production of flake and synthetic graphite, since they are superior in their properties. Capacity growth through experienced companies and fresh exploration in the emerging Latin America, among others, is on the rise. Furthermore, the supply chain decoupling of China has brought about investment in other sources. The changing investment pattern of the graphite industry is also characterized by strategic partnerships, technology-based production processes, and sustainable mining processes.

Country Market Growth

Brazil has held the largest market for the consumption of graphite in the Latin American region. As the country is home to the largest population, urban centers, and the largest economy in the region, all of which are significant in improving its market share. Additionally, in recent years, the industrialization and consumer goods production related to graphite have all improved noticeably, all of which are contributing their share to the market expansion of graphite in the Latin America region. Additionally, many of the new graphite manufacturing plants have been established in the country, which would be crucial to reduce the import dependence as well as reduce the prices. For instance, in December 2024, the operations of Graphic’s first plant were initiated in Brazil. According to the company, it has ramped up its capability to produce 5500 tons of graphite by August 2025 (under an 8-month program).

Click here to view the Report Description & TOC https://univdatos.com/reports/latin-america-graphite-market

“Investments Driving a Sustainable Graphite Future”

To conclude, the market of graphite in Latin America is improving at a high rate, which is supported by the use of synthetic graphite for industrial demand, as well as strategic investment. Brazil is the regional market leader in both consumption and production, which the new manufacturing plants facilitate, making the market well-positioned to develop sustainably. The balance between performance, cost, and ESG will characterize its competitiveness in the long term.

Related Report:-

Molybdenum Market: Current Analysis and Forecast (2025-2033)

Laser Debonding Equipment Market: Current Analysis and Forecast (2025-2033)

Thorium Market: Current Analysis and Forecast (2024-2032)

Friction Stir Welding (FSW) Equipment Market: Current Analysis and Forecast (2025-2033)

Halide Minerals Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/