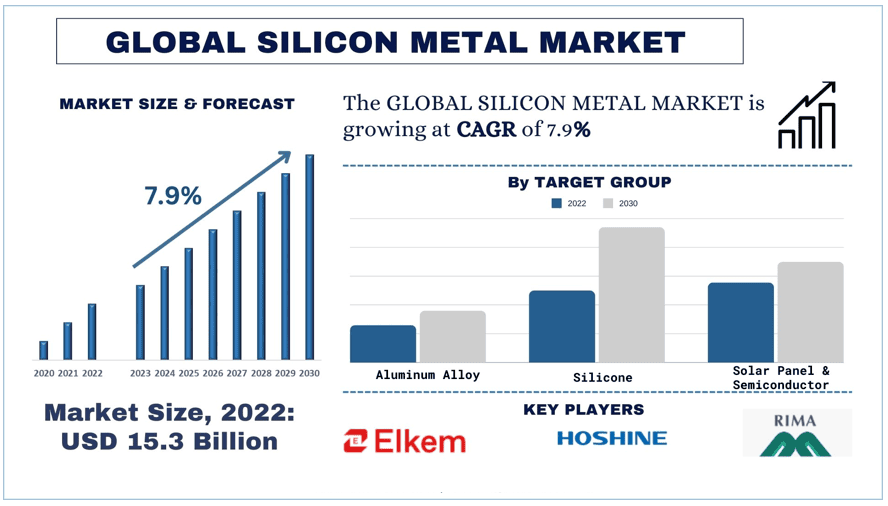

As per their “Silicon Metal Market” report, the global market was valued at USD 15.3 Billion in 2022, growing at a CAGR of 7.9% during the forecast period from 2023 - 2030 to reach USD 29.2 Billion by 2030.

Increasing demand from semiconductor applications driving market growth.

Rising Investments in Solar Panels: Growing need for silicon in electronics and solar panels.

Regional Dominance: Asia Pacific is expected to hold the highest market share in the Silicon Metal market, with China, South Korea, and Japan being key players in the region.

Technological Advancements: Transition towards electric vehicles using silicon-based components.

Demand from energy storage markets and Rising demand for aluminum alloys in the automotive industry.

The silicon metal market is a growing industry with significant potential for expansion with measures being taken to reduce production costs by improving current technologies. The market is also influenced by factors such as the availability of raw materials, government policies, and environmental concerns. The increasing demand for silicon in electronics and solar panels is a significant driver of market growth.

The proliferation of electronic devices, the global push for renewable energy, and the transition towards electric vehicles using silicon-based components are key factors fueling this demand. Moreover, The expanding middle class in emerging economies has led to increased demand for consumer electronics, further driving the silicon metal market. Countries like China, Japan, and South Korea with growing automobile sectors and progressing economic activities contribute significantly to the demand for silicon metal. Silicon metal plays a crucial role in strengthening aluminum products used in automotive applications due to its exceptional mechanical properties, corrosion resistance, and wear resistivity.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/silicon-metal-market?popup=report-enquiry

According to the China Photovoltaic Industry Association, in 2022, China’s polysilicon production was around 811,000 tons, a year-on-year increase of 65.5%. In December 2022, the price of silicon, the key raw material of solar panels, started to drop. In January, the price of polysilicon — a lower-quality blend of silicon from different sources — fell below $22,103 per ton, a drop of more than 50% from the previous month. This will have a positive impact as silicon materials will not be a bottleneck restricting demand, and the first impact of the lower upstream costs is an increase in the production of the downstream solar panels and components. Lower production costs will likely give a boost to both local and foreign demand in China’s PV industry in 2023, thus giving boost to silicon metal market during the forecast period.

Government Policies Supporting the End-User Industry

There has been a rise in demand for renewable energy and many countries are planning to diversify their energy portfolio in order to become less dependent on conventional sources of energy. Most of the governments have started addressing climate issues and have introduced many new renewable energy schemes to reduce carbon emissions globally. Governments across the world are coming together for initiatives such as Paris Climate Agreement and this is acting as a catalyst in the growth of the Silicon Metal Market.

Click here to view the Report Description & TOC: https://univdatos.com/reports/silicon-metal-market

Along with national schemes, various types of policy are indirectly driving silicon metal market growth, including auctions, feed-in tariffs, net-metering and contracts for difference.

Some of the policies which are majorly impacting the Silicon Metal market are –

China published its 14th Five-Year Plan in June 2022, which includes an ambitious target of 33% of electricity generation to come from renewables by 2025 (up from about 29% in 2021), including an 18% target for wind and solar technologies.

In August 2022, the federal government of the United States introduced the Inflation Reduction Act, a law significantly expanding support for renewable energy in the next 10 years through tax credits and other measures.

In July 2021, the European Commission proposed to increase the bloc’s renewable energy target for 2030 from 32% to 40%. The proposed target was further increased by the REPowerEU Plan to 45% in May 2022 (which would require 1 236 GW of total installed renewable capacity, including 600 GW of solar PV). Many European countries have already expanded their solar PV support mechanisms in order to accelerate capacity growth with a view to the 2030 targets and in response to the energy crisis caused by Russia’s invasion of Ukraine.

During COP26, held in November 2021 in Glasgow, India announced new 2030 targets of 500 GW of total non-fossil capacity and 50% renewable electricity generation share (more than double the 22% share in 2020), as well as net zero emissions by 2070, with solar PV being one of the main technologies used to achieve these goals.

Conclusion

In conclusion, the Silicon Metal market is experiencing significant growth and is projected to continue expanding. Factors driving this growth include the demand for silicon metal in solar panels. The market is influenced by the increasing investment in solar renewable energy. Asia-Pacific region dominates the market due to urbanization and industrial progress, particularly in countries like China, Japan, South Korea, and India. According to the UnivDatos, the rising sales of solar panels and increasing investment in semiconductor products will drive the global scenario of the Silicon Metal market .

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2023−2030

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis by Product Type, and Application

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Contact Us:

UnivDatos

Email: contact@univdatos.com

Contact no: +1 978 7330253

Website: www.univdatos.com

Linked In: https://www.linkedin.com/company/univ-datos/