Market Overview

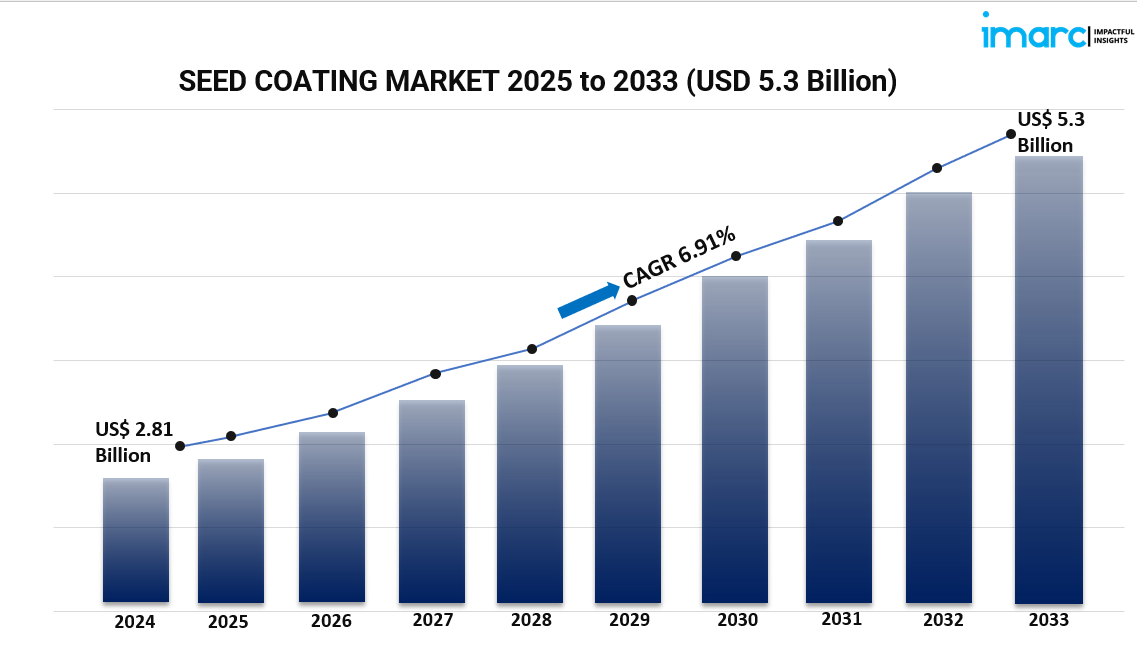

The global seed coating market was valued at USD 2.81 Billion in 2024 and is projected to reach USD 5.3 Billion by 2033, growing at a CAGR of 6.91% from 2025 to 2033. Growth is driven by the rising need to enhance crop productivity on limited agricultural land and increased adoption of advanced farming technologies. Innovations in polymers and biodegradable coatings that integrate nutrients and protect seeds also contribute significantly.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Seed Coating Market Key Takeaways

- The global seed coating market size was valued at USD 2.81 Billion in 2024, with a forecasted CAGR of 6.91% from 2025 to 2033.

- North America dominated the market in 2024 with over 39.8% share, driven by advanced farming technologies and R&D.

- Polymers accounted for the largest additive type segment, holding a 30.2% market share in 2024.

- Film coating was the leading process segment due to its efficient, uniform, and thin protective seed layers.

- Cereals and grains held the largest crop type segment with 26.8% market share in 2024.

- Precision agriculture adoption is influencing demand for coated seeds by enhancing planting accuracy and resource efficiency.

Sample Request Link: https://www.imarcgroup.com/seed-coating-market/requestsample

Market Growth Factors

Increasing global population and decreasing availability of arable land have compelled farmers to adopt seed coatings to enhance crop productivity. According to FAO, arable land was 1.38 billion hectares in 2019, but UNCCD reports a loss of at least 100 million hectares annually from 2015 to 2019. Seed coatings improve germination, protect seeds from pests and diseases, and help seedlings withstand environmental stress, optimizing productivity on limited farmland.

Innovations in seed coating materials, especially polymers and biodegradable technologies, have significantly boosted market growth. Polymers held a 30.2% market share in 2024 due to their ability to form durable, uniform films that improve seed flowability and protection. The Indian Institute of Oilseeds Research introduced a patented biopolymer technology in 2024 that increases crop yields by 25-30%, indicating technological progression toward sustainable agriculture.

The rising adoption of precision agriculture, valued at USD 9.3 billion in 2024, is a crucial driver. Coated seeds' uniformity supports mechanical sowing accuracy, reduces seed wastage, and facilitates uniform crop growth, aligning perfectly with precision farming requirements. This trend is expected to continue as precision agriculture grows to USD 10.7 billion by 2032, fostering seed coating market expansion.

Market Segmentation

Additive Type:

- Polymers: Leading segment with 30.2% market share in 2024. They form durable, uniform films enhancing seed flowability, mechanical sowing precision, and protection against environmental stresses.

- Colorants

- Pellets

- Binders

- Active Ingredients

- Others

- Process:

- Film Coating: Largest segment due to its ability to apply a thin, uniform, protective layer without increasing seed size or weight. It enhances flowability, allows integration of active ingredients, and supports sustainable agriculture.

- Encrusting

- Pelleting

Crop Type:

- Cereals and Grains: Leading segment with 26.8% market share in 2024, important for global food production. Coatings enhance germination, pest resistance, and drought tolerance.

- Fruits and Vegetables

- Flowers and Ornamentals

- Oilseeds and Pulses

- Others

Regional Insights

North America dominated the seed coating market in 2024, accounting for 39.8% of the total market share. Advanced agricultural technologies, strong R&D initiatives, and high demand for high-yield crops like corn, soybeans, and wheat underpin this dominance. The region's adoption of precision agriculture, projected to reach USD 10.7 billion by 2032, also fosters demand for tailored seed coatings enhancing crop productivity efficiently.

Recent Developments & News

- December 2024: BioConsortia partnered with New Zealand’s H&T to launch FixiN 33, a nitrogen-fixing microbial seed treatment for corn, brassicas, and cereals, reducing nitrogen fertilizer dependency while maintaining yields.

- January 2024: Lucent BioSciences introduced Nutreos, a non-toxic, plant-based, biodegradable micronutrient seed coating aligning with anticipated EU microplastic ban laws and sustainability.

Key Players

- BASF SE

- Brett-Young Seeds Limited

- Centor Oceania

- Chromatech Incorporated

- Cistronics Innovations Pvt. Ltd.

- Croda International plc

- Germains Seed Technology

- Precision Laboratories LLC

- Sensient Colors LLC (Sensient Technologies Corporation)

- Solvay

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for customization: https://www.imarcgroup.com/request?type=report&id=7081&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302