The Artificial Intelligence (AI) in Insurance Market is undergoing a profound transformation as insurers worldwide increasingly adopt AI-driven technologies to enhance efficiency, accuracy, and customer engagement. From automated claims processing and predictive risk modeling to fraud detection and personalized policy offerings, AI is reshaping the insurance value chain. As digital transformation accelerates across the financial services sector, insurance companies are leveraging artificial intelligence to remain competitive, reduce operational costs, and meet evolving consumer expectations.

AI-powered solutions are no longer experimental tools; they have become mission-critical systems enabling insurers to make faster decisions, minimize losses, and improve profitability. This article provides a comprehensive, in-depth analysis of the AI in insurance market, covering market dynamics, technology trends, applications, regional outlook, competitive landscape, and future growth opportunities.

Market Overview

The AI in insurance market is experiencing robust growth driven by the increasing volume of structured and unstructured data, rising fraud cases, demand for real-time risk analysis, and the need for enhanced customer experience. Insurers are integrating AI technologies such as machine learning, natural language processing (NLP), computer vision, and predictive analytics to automate manual workflows and extract actionable insights from vast datasets.

AI adoption spans across life insurance, health insurance, property and casualty insurance, and reinsurance. Insurtech startups and established insurers alike are investing heavily in AI-based platforms to modernize underwriting, pricing, claims management, and customer service operations.

Tap into future trends and opportunities shaping the Artificial Intelligence (AI) in Insurance Market . Download the complete report:

Key Drivers of the Artificial Intelligence in Insurance Market

Rising Need for Fraud Detection and Prevention

Insurance fraud remains a significant challenge globally, resulting in substantial financial losses each year. AI algorithms can analyze patterns, detect anomalies, and identify suspicious claims with higher accuracy than traditional rule-based systems. Machine learning models continuously improve over time, making fraud detection faster and more precise.

Demand for Automated Claims Processing

Claims processing is one of the most time-consuming and cost-intensive functions in insurance operations. AI-powered automation enables insurers to assess claims, validate documents, estimate damages, and approve settlements in real time. This not only reduces operational costs but also improves customer satisfaction through faster claim resolution.

Growth in Digital Insurance Platforms

The rise of digital insurance platforms and mobile applications has increased the demand for AI-driven personalization. Insurers use AI to tailor policy recommendations, pricing, and coverage based on individual customer behavior, demographics, and risk profiles.

Increasing Adoption of Big Data Analytics

Insurance companies generate massive volumes of data from customer interactions, IoT devices, telematics, medical records, and social media. AI enables advanced data analytics, helping insurers extract valuable insights for underwriting, pricing, and risk management.

Technology Landscape

Machine Learning

Machine learning dominates the AI in insurance market due to its ability to learn from historical data and improve predictive accuracy. It is widely used in underwriting, fraud detection, claims management, and customer segmentation.

Natural Language Processing (NLP)

NLP enables insurers to process and analyze unstructured text data such as emails, claims forms, medical reports, and customer feedback. Chatbots and virtual assistants powered by NLP enhance customer support and policy servicing.

Computer Vision

Computer vision is gaining traction in claims assessment, especially in property and vehicle insurance. AI-driven image recognition can evaluate damage from photos or videos, significantly reducing the need for manual inspections.

Predictive Analytics

Predictive analytics helps insurers forecast future risks, customer behavior, and claim probabilities. This technology supports more accurate pricing models and proactive risk mitigation strategies.

Application Analysis

Underwriting and Risk Assessment

AI enables data-driven underwriting by analyzing historical claims data, customer profiles, and external risk factors. Automated underwriting improves accuracy, reduces bias, and accelerates policy issuance.

Claims Management

AI-powered claims management systems streamline the entire claims lifecycle, from first notice of loss to settlement. Automation reduces human intervention, minimizes errors, and speeds up claim payouts.

Fraud Detection

Advanced AI models identify fraudulent activities by detecting abnormal patterns and inconsistencies in claims data. Real-time fraud detection significantly reduces financial losses and enhances trust in insurance systems.

Customer Service and Engagement

AI chatbots and virtual assistants provide 24/7 customer support, handling inquiries, policy renewals, and claims status updates. Personalized engagement improves customer retention and brand loyalty.

Pricing and Policy Optimization

AI-driven pricing models dynamically adjust premiums based on risk factors, customer behavior, and market conditions. This enables insurers to offer competitive pricing while maintaining profitability.

Insurance Type Outlook

Life and Health Insurance

AI plays a crucial role in health risk assessment, medical underwriting, and claims automation. Predictive analytics helps insurers design personalized health plans and manage long-term risk exposure.

Property and Casualty Insurance

In property and casualty insurance, AI enhances damage assessment, catastrophe modeling, and fraud detection. Telematics and IoT data further improve risk evaluation and pricing accuracy.

Reinsurance

Reinsurers use AI to analyze large-scale risk portfolios, simulate catastrophe scenarios, and optimize capital allocation. AI-driven insights support better decision-making in complex reinsurance contracts.

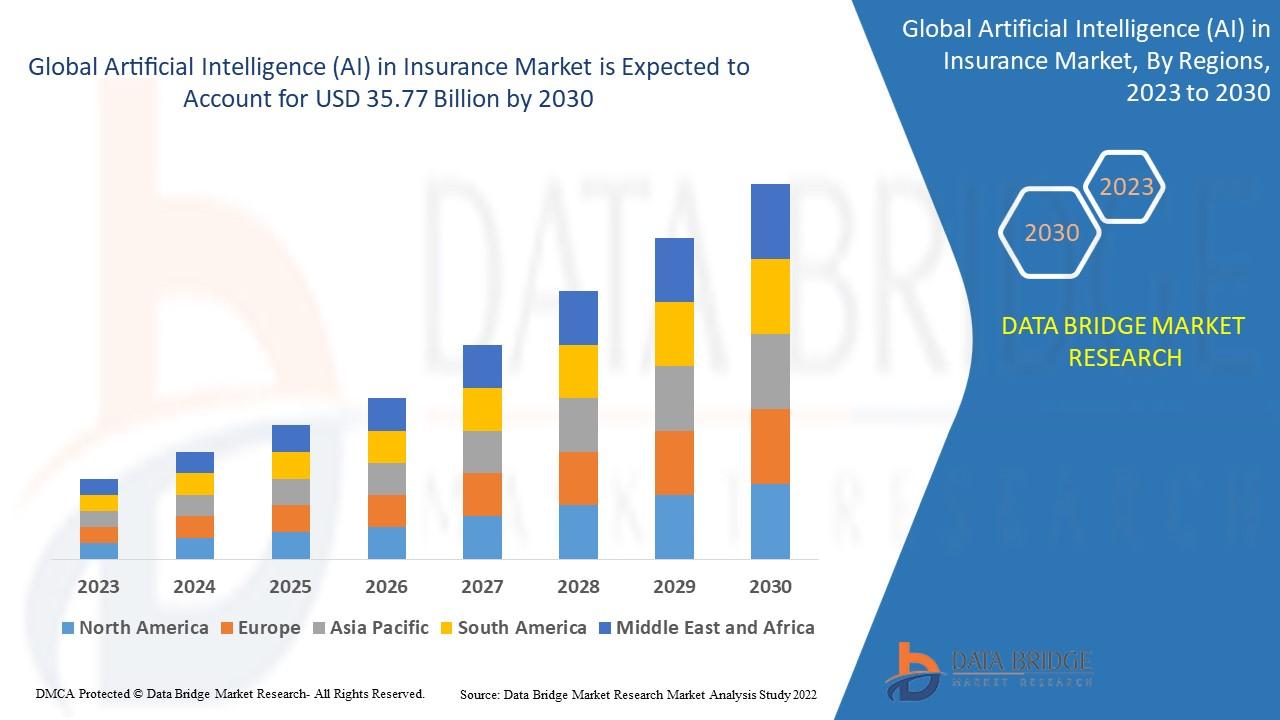

Regional Analysis

North America

North America leads the AI in insurance market due to early technology adoption, strong presence of leading insurers, and advanced digital infrastructure. High investment in insurtech innovation continues to drive market growth.

Europe

Europe is witnessing steady growth supported by regulatory frameworks encouraging digital transformation and data protection. Insurers are increasingly deploying AI for compliance, risk management, and customer analytics.

Asia-Pacific

The Asia-Pacific region is expected to experience the fastest growth, driven by rapid digitalization, expanding insurance penetration, and rising adoption of AI-powered mobile insurance platforms.

Latin America and Middle East & Africa

These regions are gradually adopting AI in insurance as insurers modernize legacy systems and expand digital distribution channels. Growing awareness and improving connectivity support long-term market potential.

Competitive Landscape

The artificial intelligence in insurance market is highly competitive, featuring a mix of established insurance providers, technology vendors, and innovative insurtech startups. Companies are focusing on strategic partnerships, AI platform development, and continuous innovation to strengthen their market position.

Key competitive strategies include:

-

Investment in proprietary AI models

-

Integration of AI with core insurance systems

-

Expansion of AI-driven customer engagement tools

-

Focus on explainable AI for regulatory compliance

Challenges and Restraints

Despite its strong growth potential, the AI in insurance market faces certain challenges:

-

Data privacy and security concerns

-

High implementation and integration costs

-

Lack of skilled AI professionals

-

Regulatory and compliance complexities

-

Bias and transparency issues in AI algorithms

Addressing these challenges is essential for sustainable and ethical AI adoption in insurance.

Future Outlook and Opportunities

The future of the AI in insurance market looks highly promising. Advancements in generative AI, explainable AI, and real-time analytics will further transform insurance operations. Insurers are expected to increasingly adopt AI-driven decision intelligence to enhance agility, resilience, and customer-centricity.

Emerging opportunities include:

-

AI-powered parametric insurance

-

Usage-based and on-demand insurance models

-

Integration of AI with blockchain and IoT

-

Hyper-personalized insurance products

-

Autonomous claims processing systems

As competition intensifies, insurers that strategically invest in AI innovation will gain a decisive edge in efficiency, risk management, and customer satisfaction.

Conclusion

The Artificial Intelligence (AI) in Insurance Market is redefining how insurance companies operate, compete, and serve customers. AI technologies are enabling smarter underwriting, faster claims processing, robust fraud detection, and personalized customer experiences. With continued advancements in machine learning, NLP, and predictive analytics, AI will remain a cornerstone of insurance innovation.

Browse More Reports:

Global Water Treatment Chemicals Market

Global Scented Candle Market

Global Ceramics Market

Europe Japanese Restaurant Market

Global Smart Fleet Management Market

Global Tuna Market

Global Tote Bags Market

Global Gemstones Market

Global Japanese Restaurant Market

Global Hypochlorous Acid Market

Global Toothbrush Market

Global Cataracts Market

Global Wire and Cable Market

Global Plant-Based Food Market

Global Tomatoes Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com