The electrical & electronics PEEK market is projected to grow from USD 0.47 billion in 2025 to USD 0.70 billion by 2030, at a CAGR of 8.1% during the forecast period. This report provides a comprehensive analysis of the market, including market size, share, demand with electrical & electronics PEEK market trends, drivers and constraints, competitive aspects, and prospects for future growth. The market is gaining strong momentum, supported by the rising demand for high-performance engineering polymers, and the growing use of PEEK in critical applications across aerospace, medical, electrical & electronics, and industrial sectors. Germany and China are home to a large concentration of aerospace OEMs, medical implant developers, semiconductor manufacturers, and high-tech industries. Increasing requirements for lightweight materials, high thermal stability, chemical resistance, and long-term durability are accelerating the shift from metals and lower-performance polymers to PEEK-based solutions. Additionally, the rapid expansion of minimally invasive medical devices, electrification of the automotive sector, and growth in semiconductor equipment manufacturing are further driving adoption, positioning Asia Pacific as a key innovation hub and one of the most attractive markets for advanced PEEK materials.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=239698329

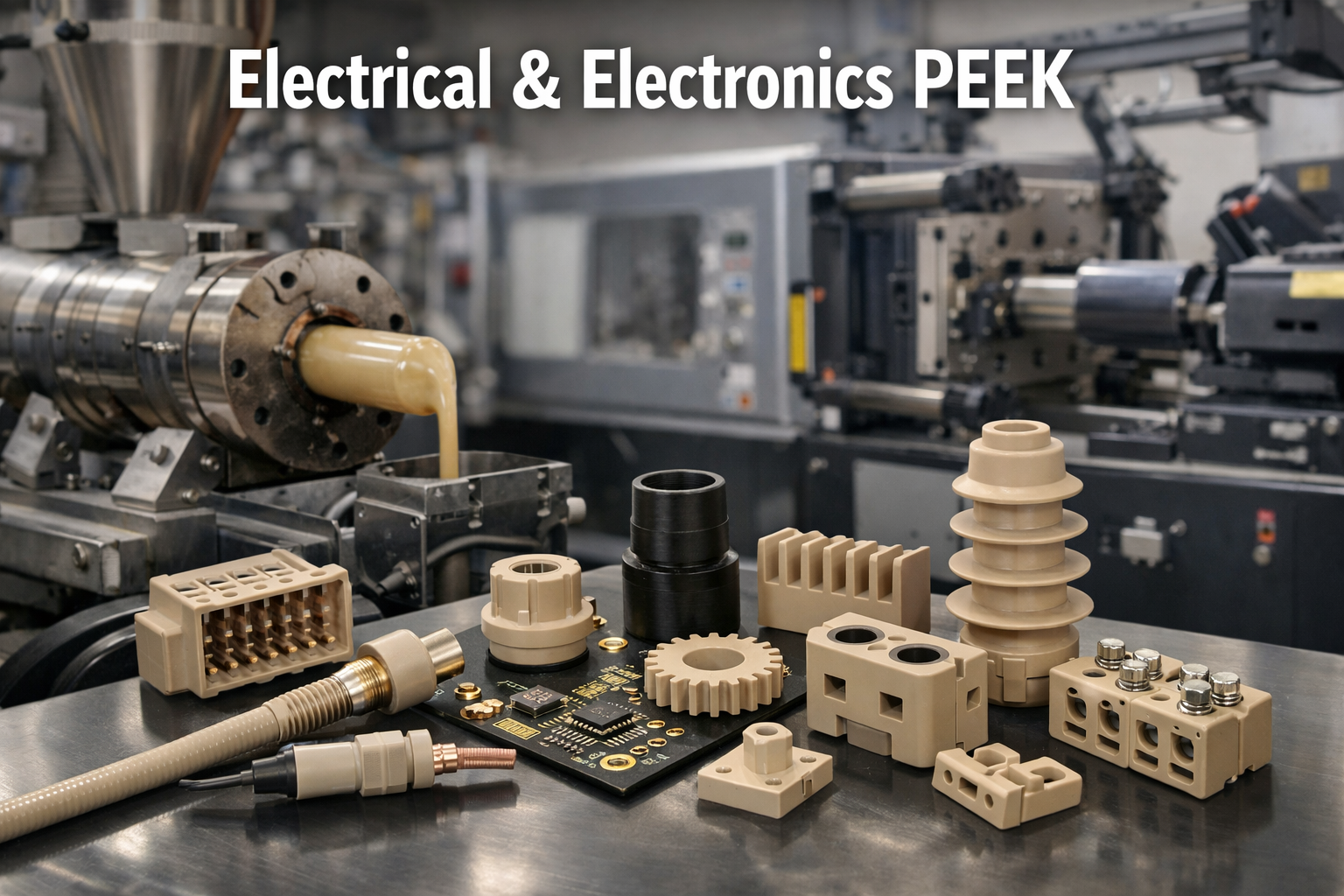

The electrical & electronics PEEK market is primarily driven by the growing requirement for advanced materials capable of delivering reliable performance under extreme operating conditions. As electronic devices and electrical systems become more compact, powerful, and complex, manufacturers are seeking materials that combine superior electrical insulation, mechanical strength, and resistance to heat and chemicals. PEEK fulfills these requirements with its outstanding thermal stability, chemical inertness, and consistent electrical performance, making it suitable for demanding applications such as connectors, insulators, semiconductor components, and precision electronic parts. The ongoing trend toward device miniaturization and higher power densities has further increased the need for materials like PEEK that can meet stringent performance and safety standards in next-generation electronic systems.

estraint: Elevated cost of PEEK material

The high cost of PEEK remains a key limiting factor for its wider adoption in the electrical & electronics sector. PEEK production involves complex, energy-intensive manufacturing processes, which significantly increase raw material and processing costs. As a result, PEEK components are more expensive than those made from conventional plastics or metals, making them less viable for high-volume, cost-sensitive applications. Budget constraints often lead manufacturers to opt for alternative materials that offer acceptable performance at lower costs. This price barrier can be particularly restrictive for small and mid-sized companies, slowing the overall penetration of PEEK across mainstream electrical and electronic applications.

Opportunity: Growth of 5G infrastructure and devices

The rapid expansion of 5G networks presents a strong growth opportunity for the electrical & electronics PEEK market. The deployment of 5G technology requires materials that can withstand high frequencies, elevated temperatures, and harsh operating environments while maintaining stable electrical performance. PEEK’s excellent insulation properties, thermal resistance, and chemical durability make it highly suitable for critical 5G components such as connectors, cables, antennas, and semiconductor housings. As global investments in 5G infrastructure and advanced communication devices continue to rise, demand for high-performance materials like PEEK is expected to increase significantly within the electrical & electronics industry.

Challenge: Competition from alternative materials

Intense competition from alternative high-performance materials poses a major challenge to the electrical & electronics PEEK market. While PEEK offers superior overall performance, materials such as polyimides, polyesters, and certain ceramics can provide comparable thermal and electrical properties at a lower cost. These substitutes are often easier to process and more economical, making them attractive options for manufacturers in price-sensitive applications where PEEK’s premium performance is not essential. Additionally, ongoing development of advanced polymers and composite materials continues to increase competitive pressure, potentially limiting the market share growth of PEEK in certain electrical and electronic applications.

Get a Sample Copy of This Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=239698329

Electrical & Electronics PEEK Market Segmentation

By Processing Method

-

Injection Molding:

-

Widely used for manufacturing complex and high-precision electronic components

-

Suitable for connectors, insulators, and sensor housings

-

Offers high repeatability and tight dimensional control

-

-

Extrusion:

-

Used for continuous profiles such as wires, cables, tubes, and films

-

Provides uniform electrical insulation and thermal stability

-

Preferred for applications requiring consistent cross-sectional properties

-

By Reinforcement Type

-

Glass-Filled PEEK:

-

Enhances stiffness, dimensional stability, and electrical insulation

-

Commonly used in connectors and structural electronic components

-

-

Carbon-Filled PEEK:

-

Provides superior mechanical strength, thermal conductivity, and wear resistance

-

Suitable for high-performance electronics and semiconductor equipment

-

-

Unfilled PEEK:

-

Offers high purity, excellent electrical insulation, and chemical resistance

-

Used in sensitive electronic and semiconductor applications

-

Speak to Expert: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=239698329

By Region

-

Asia Pacific:

-

Largest market share driven by electronics manufacturing and semiconductor growth

-

Strong demand from 5G, EVs, and consumer electronics

-

-

North America:

-

Growth supported by advanced electronics and high-reliability electrical systems

-

Strong focus on innovation and high-performance materials

-

-

Europe:

-

Demand driven by industrial electronics, aerospace, and energy applications

-

Emphasis on quality standards and sustainable materials

-

-

Latin America & Middle East & Africa:

-

Emerging markets with steady growth

-

Driven by industrialization and expanding electrical infrastructure

-

Based on reinforcement type, the glass-filled segment is projected to register the highest growth in the electrical & electronics PEEK market, driven by the rising need for high-performance electrical components and advanced electronic systems. The outstanding electrical insulation properties, high thermal stability, flame resistance, and durability of PEEK are factors that make it particularly suitable for manufacturing connectors, cable insulations, and electronic housing components that are required to operate accurately under high temperatures and varying operational conditions. The miniaturization of electronic components, the gradual switching to smart devices, the expansion of telecom networks, and the rising fusion of electronics in automotive and industrial applications fuel the demand for high-performance materials.

Inquire Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=239698329

Based on region, Asia Pacific is projected to register the highest growth rate in the electrical & electronics PEEK market, mainly because of the region's strong industrial foundation and technological development. The already established automotive and manufacturing sectors in China are making use of high-performance materials like PEEK in applications that need heat resistance, mechanical strength, and long-term reliability. Examples of such applications are engine components, sensors, and high-precision parts. The electrical & electronics industry, which includes advanced automation, renewable energy systems, and industrial controls, is a major contributor to the manufacturers' demand for PEEK materials with excellent electrical insulation and thermal stability. On the other hand, Asia Pacific has been the center of innovation and the main place where the development of advanced materials has been taking place. This has made the use of PEEK in aerospace, medical devices, and industrial engineering possible, where high-performance polymers can seamlessly substitute metals and cut down the weight while maintaining strength. China's comprehensive industrial infrastructure, along with strong investment in engineering and high-tech manufacturing, has created a very favorable environment for PEEK suppliers, further ensuring the country's dominance and rapid growth in the electrical & electronics PEEK market.

Electrical & Electronics PEEK Comapnies

Leading players operating in the electrical & electronics PEEK market include Victrex Plc (UK), Syensqo (Belgium), Evonik Industries AG (Germany), Jilin Joinature Polymer Co., Ltd. (China), JUNHUA (China), Mitsubishi Chemical Group (Japan), Avient Corporation (US), SurloIndia (India), J.K. Overseas (India), Caledonian Industries Limited (UK), RTP Company (US), Westlake Plastics (US), Drake Plastics (US), Americhem (US), LATI Industria Termoplastici S.p.A. (Italy), Lehmann&Voss&Co. (Germany), Polymer Industries (US), Toray Plastics Precision Co., Ltd., Trident Plastics Inc. These companies have widespread facilities, an established portfolio of PEEK, a robust market presence, and strong business strategies.

Victrex Plc (UK)

Victrex plc is one of the leading companies providing polyether ether ketone (PEEK) and polyaryle ether ketone (PAEK)-based polymer solutions. Specializing in high-performance polymers, PEEK films, lightweight metal replacement solutions, and gear solutions, the company serves six core markets, including aerospace, automotive, energy, electronics, industrial, and medical. It operates through two segments: Sustainable Solutions and Medical. The Sustainable Solutions segment caters to energy & industrial, transport, and electronics markets, whereas the medical segment focuses on providing specialized solutions for medical device manufacturers. The company has a presence in nearly 40 countries across Europe, the Americas, Asia Pacific, the Middle East, and Africa.

Syensqo (Belgium)

Syensqo became an independent specialty chemicals company following its spin-off from Solvay in 2023. Operating across both upstream and downstream segments of the value chain, the company produces intermediate products and tailored formulations, with expertise spanning multiple industries, including surfactants, solvents, and composite materials. It operates through three segments: Materials, Consumer & Resources, and Corporate & Business Services. The Materials segment provides high-performance polymers and composites for automotive, aerospace, healthcare, and electronics industries. The Consumer & Resources segment delivers specialty formulations for surface chemistry and liquid behavior, serving coatings, oil & gas, resource extraction, consumer goods, and healthcare industries. Syensqo marks its global presence through 62 industrial sites and 12 research and innovation centers in 30 countries across the Americas, Europe, the Middle East, Africa, and Asia Pacific.

Request for Customisation: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=239698329

Evonik Industries AG (Germany)

Evonik Industries AG is one of the world's leading specialty chemicals companies. The company operates through five segments: Specialty Additives, Nutrition & Care, Smart Materials, Performance Materials, and Technology & Infrastructure. The Specialty Additives segment focuses on high-performance additives and crosslinkers that enhance product durability, energy efficiency, and performance. The Nutrition & Care segment develops functional active ingredients for human and animal health, prioritizing well-being and quality of life. The Smart Materials segment supplies high-performance materials for energy-efficient applications in various industries. The Performance Materials segment produces intermediates for the mobility, plastic, and rubber industries. The Technology & Infrastructure segment supports chemical production with expertise in innovation and digitization. Evonik provides PEEK in various grades, including implant-grade, dental-grade, and care-grade, under the VESTAKEEP brand. With a presence in 100 countries and production facilities at 104 locations across 27 countries, it serves diverse industries, such as automotive, pharmaceutical, renewable energy, consumer goods, food, and animal feed.

Jilin Joinature Polymer Co., Ltd. (China)

Jilin Joinature Polymer Co., Ltd. was listed on the New OTC Market in 2015. It is a modern enterprise engaged in R&D, manufacturing, and marketing of PEEK products. Its current annual capacity is 1,500 tons of PEEK. The company holds two international invention patents, 22 domestic invention patents, and nine utility model patents. It produces a wide variety of products that can be summarized as Grade G PEEK Pure Resin Pellets, Grade PF PEEK Pure Resin Fine Powder, Grade P PEEK Pure Resin Coarse Powder, Grade GL Glass Filled Fiber Reinforced PEEK, Grade CA Carbon Fiber Reinforcement PEEK, Grade FC Super Wear Resistant PEEK, and Grade R&D PEEK. These PEEK products find application in the manufacture of tube materials, medical materials, wire insulation materials, bearing materials, and seal materials.

JUNHUA (China)

JUNHUA initially began as a producer of precision PEEK parts and has since evolved into a fully integrated PEEK materials company. In 2013, it became one of the first companies in China to achieve mass extrusion of PEEK stock shapes, and by 2020, through its subsidiary Shandong Junhao, completed the whole industrial chain of PEEK - from the polymerization of raw materials to finished parts. With over 17 years of expertise, the company specializes in high-performance engineering plastics, offering PEEK, PI, and PPSU in the form of raw materials, semi-finished shapes, and precisely processed components. Its end-use industries include aerospace, medical, food processing, mechanical engineering, oil & gas, and semiconductors. It has a presence in Europe, North America, and Asia Pacific.