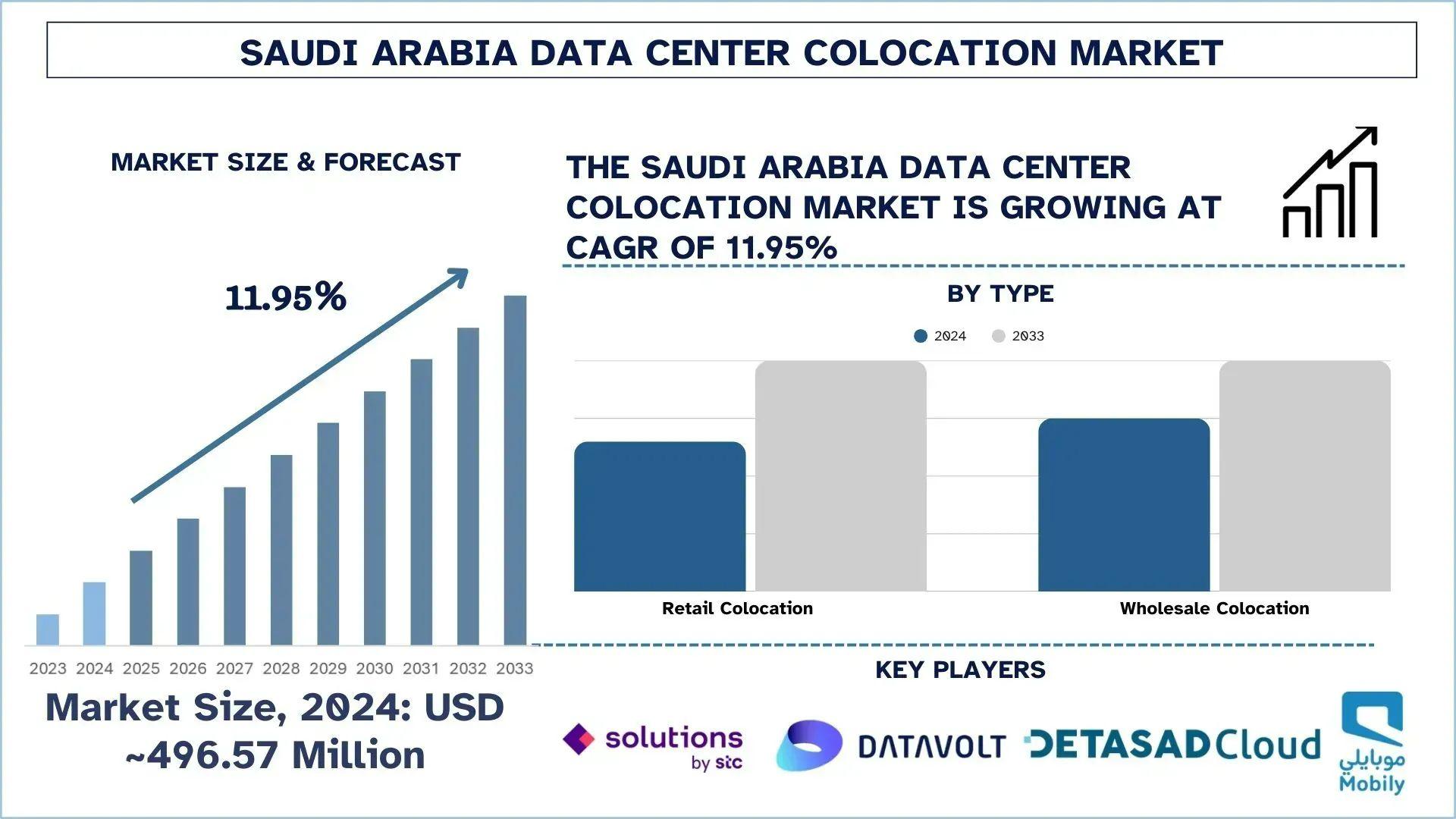

According to UnivDatos, Vision 2030 initiatives accelerating digital infrastructure and smart city development, growing cloud adoption and hybrid IT strategies across industries, rising demand for data localization due to regulatory and compliance requirements, expansion of digital banking and fintech driving secure hosting needs, and rapid growth of e-commerce and online platforms requiring scalable infrastructure drive the Saudi Arabia Data Center Colocation market. As per their “Saudi Arabia Data Center Colocation Market” report, the market was valued at USD 496.57 Million in 2024, growing at a CAGR of about 11.95% during the forecast period from 2025 - 2033 to reach USD Million by 2033.

The data center colocation market of Saudi Arabia is in a transformative period of growth due to ambitious government policies, increased foreign investments, and a robust push to digital sovereignty. A combination of Vision 2030, the national Cloud-First Policy, and a surge in strategic partnering is positioning the Kingdom to become the most popular digital hub throughout the Middle East.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/saudi-arabia-data-center-colocation-market?popup=report-enquiry

Increasing Investments and Market Confidence

The growth in investments in colocation infrastructure in Saudi Arabia has been notable, indicating increased confidence in the country's digital aspirations. Hyperscale facilities are being constructed across Riyadh, Jeddah, and Dammam, and it is planned to expand to mega-projects like NEOM. Such investments are not domestic or local but also international, as the global players are looking at Saudi Arabia as a strategic entry point into the larger MENA region. Submarine cables and the geographical location of the Kingdom also add to its reputation as a regional digital transit centre. The youthful, tech-friendly population of Saudi Arabia and the growing digital services market in the country are especially appealing to investors, as they ensure continued growth in the market of colocation capacity.

For example, on February 17, 2025, Etihad Etisalat Company (Mobily) announced that it would invest a substantial SAR 3.4 billion (approximately USD 905 million) in digital infrastructure in the Middle East. The announcement was made during the concluded LEAP 2025 technology conference in Riyadh. The amount would be invested in data centers, submarine cables, and fiber networks.

For instance, on January 17, 2025, Gulf Data Hub and KKR announced that funds affiliated with KKR will acquire a stake in GDH. The investment, which is subject to customary regulatory approvals, is being made through KKR’s Global Infrastructure strategy. KKR and GDH are committing to support over USD 5 billion of total investment to build out data center capacity, supporting the significant rise in hyperscale demand, AI, and digital-focused national priorities across the Gulf countries.

Cloud-First Policy Adoption

As per the Digital Government Authority (DGA), the Cloud First Policy (CFP) guides Saudi Arabia’s governmental entities in accelerating the adoption of cloud computing services. In accordance with this policy, cloud solutions should be viewed as a priority by entities in the course of making new IT investment choices. The private sector is also encouraged to adopt similar internal policies to maximize the benefits of cloud technology.

In line with the vision 2030, the CFP supports the National Information Center’s (NIC) Strategy, positioning it as the primary Cloud Service Provider (CSP) for government data. The fact that Saudi Arabia is at the forefront of the ICT sector, especially in the Middle East and North Africa (MENA) region, consolidates its capacity to leverage the opportunities of cloud computing, which may help it develop a sophisticated and integrated digital infrastructure.

Strategic Alliances Shaping the Future

The surge in strategic alliances, alongside government policies and investments, drives the market. Also, alliances among telecommunication companies, technology companies, hyperscalers, and infrastructure providers are facilitating the deployment of advanced data centers more quickly. Therefore, these partnerships introduce international expertise, capital, and advanced technologies to the Kingdom, while also ensuring adherence to local regulations. For example, on February 7, 2025, Salam partnered with Netskope, a global leader in security and networking, to enhance data center services in the Kingdom. This collaboration will leverage Salam’s advanced data center infrastructure and Netskope’s expertise to provide secure and reliable colocation services for businesses.

Click here to view the Report Description & TOC https://univdatos.com/reports/saudi-arabia-data-center-colocation-market

Vision 2030 and Cloud-First Fuel Saudi Colocation Growth

The synergy between Vision 2030, the Cloud-First Policy, and the increasing rate of strategic alliances forms an effective ground for the consistent growth in the market. The level of investments in colocation infrastructure is set to continue increasing, as both the government and the non-governmental actors are converging to achieve the national agenda of digital transformation. With the evolution of regulatory frameworks and the expansion of global partnerships, the data center colocation market in Saudi Arabia is expected to further develop as the country transitions into a regional power, rather than a national need. The future will be determined by the advancement in green energy, AI-ready infrastructure, and the extension into new urban and economic areas.

Related Report:-

India Data Center Market: Current Analysis and Forecast (2024-2032)

AI Data Center Market: Current Analysis and Forecast (2024-2032)

MENA Data Center Market: Current Analysis and Forecast (2023-2030)

Data Center Liquid Cooling Market: Current Analysis and Forecast (2025-2033)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/