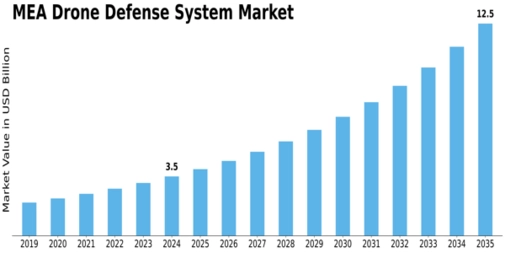

While the forecast for the MEA Drone Defense System Market looks highly promising — growing from USD 73 million in 2024 to around USD 893.44 million by 2035 with a CAGR of 25.57% — the path forward is not without challenges. For companies, governments, and stakeholders eyeing this market, strategic planning and adaptability will be key.

One of the main challenges lies in the rapid evolution of drone technology itself. As drone manufacturers continuously improve range, stealth, autonomy, and swarm capabilities, defense systems must keep pace — which requires ongoing R&D, frequent upgrades, and substantial investments in both hardware and software. This dynamic pace can strain resources, especially for smaller firms or for countries with constrained defense budgets.

Another challenge pertains to customization and local relevance. The security dynamics in MEA vary widely from country to country — from urban terrorism threats to border conflicts, from critical infrastructure protection to urban policing. A one-size-fits-all drone-defense solution may not meet these varied requirements. Therefore, defense providers must develop modular, scalable, and customizable offerings that address unique national or regional concerns.

Additionally, regulatory, ethical, and civilian-use considerations complicate market deployment. With growing civilian drone operations for logistics, commercial photography, surveying, and entertainment, authorities must balance regulation and enforcement carefully. Implementing counter-drone mechanisms — particularly kinetic or jamming-based — may raise legal, privacy, or safety concerns. This balancing act could slow down adoption in non-military contexts.

From an industry perspective, there’s also a need for collaboration and public-private partnerships. Governments may lack the in-house R&D capabilities or funding to develop cutting-edge drone-defense systems independently. Collaboration with global defense contractors, local firms, and technology innovators — along with joint-development projects — can help overcome capability gaps, enable technology transfer, and build regionally tailored solutions.

Despite these challenges, the future outlook remains strongly positive. The high projected growth, growing security pressures, rising drone threats, and increasing awareness of airspace safety all point to robust demand in the coming decade. As countries in the MEA region modernize their defense posture, update airspace regulations, and invest in comprehensive surveillance and counter-drone architectures, the market is likely to expand significantly.

Moreover, innovations — particularly in AI-based detection, sensor fusion, electronic warfare, automated neutralization, and real-time monitoring — will shape the next generation of drone-defense systems. For defense contractors and technology providers, this represents a golden opportunity to capture market share and establish long-term partnerships in a region with mounting defense and security needs.

In conclusion, while the MEA Drone Defense System Market faces technological, regulatory, and operational challenges, strategic innovation, collaboration, and tailored solutions can help unlock its full growth potential. For stakeholders ready to invest, the next decade could see significant returns — and play a foundational role in ensuring airspace security across a complex and dynamic region.

Related Report:

Related Report:

Canada Low Cost Satellite Market

China Low Cost Satellite Market

North America Low Cost Satellite Market

Europe Marine Fuel Injection Market