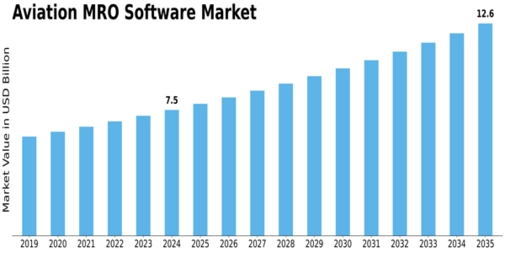

The global aviation industry is undergoing rapid transformation, and at the heart of this transformation lies the rising demand for advanced maintenance, repair and overhaul (MRO) software. The Aviation MRO Software Market is projected to reach USD 10 billion by 2030, growing at a healthy compound annual growth rate (CAGR) of 4.8% from 2024 to 2030. This expanding market size is driven by airlines’ and MRO providers’ increasing need to optimize aircraft lifecycle management, reduce turnaround time, and ensure compliance with stringent safety regulations.

One major driver is the growing complexity of modern aircraft fleets. As airlines expand their fleets to meet rising passenger demand, the volume of maintenance tasks — from scheduled checks to unscheduled repairs — increases substantially. MRO software solutions offer fleet management, inventory tracking, maintenance scheduling, and compliance management, enabling operators to manage maintenance activities more efficiently. In turn, this reduces aircraft downtime and improves aircraft reliability.

Technological innovations are also fueling market growth. Software platforms are increasingly integrating features such as digital twin modelling, predictive maintenance algorithms, data analytics, and cloud-based asset tracking. These innovations allow MRO providers to predict potential faults before they occur, schedule maintenance proactively, and optimize spare parts inventory. The result is more efficient operations, reduced maintenance costs, and better aircraft availability — critical in a high-stakes industry where downtime impacts revenue.

Another contributing factor is the shift toward software-as-a-service (SaaS) models. Rather than investing heavily in in-house maintenance management systems, airlines and MRO firms are opting for scalable, subscription-based software. This lowers upfront capital expenditure and allows for flexible, modular deployment of MRO software solutions. As a result, adoption is accelerating globally.

Additionally, the post-COVID-19 recovery in air travel is prompting airlines to modernize maintenance infrastructure. With fleet utilization climbing, there's a renewed emphasis on ensuring aircraft safety, compliance, and reliability — boosting demand for comprehensive MRO software.

In conclusion, the Aviation MRO Software Market’s strong growth projection reflects a convergence of fleet expansion, regulatory pressure, technological innovation, and evolving business models. For airlines, MRO providers, and software vendors alike, this represents a timely opportunity to leverage maintenance software to streamline operations, enhance aircraft availability, and reduce costs.

Related Report:

Manned Security Services Market OverView