The Web3 in Financial Services Industry is driving a new era of innovation in the financial sector by leveraging blockchain technology, decentralized applications, and tokenization. This industry enables enhanced transparency, security, and efficiency in financial operations while providing users with greater control over their digital assets. Smart contract banking and crypto wallets are becoming core components, offering automated, secure, and programmable financial services.

Key Growth Drivers

A major driver of growth is the rapid blockchain adoption across banking, insurance, and investment services. Financial institutions are exploring decentralized applications to streamline operations, reduce intermediaries, and improve transaction speed. Additionally, advancements in technology infrastructure, supported by the Office Contact Center Headset Market and Memory IC Market, help in creating more efficient, reliable, and secure financial platforms capable of supporting Web3 solutions.

Technology and Regional Influence

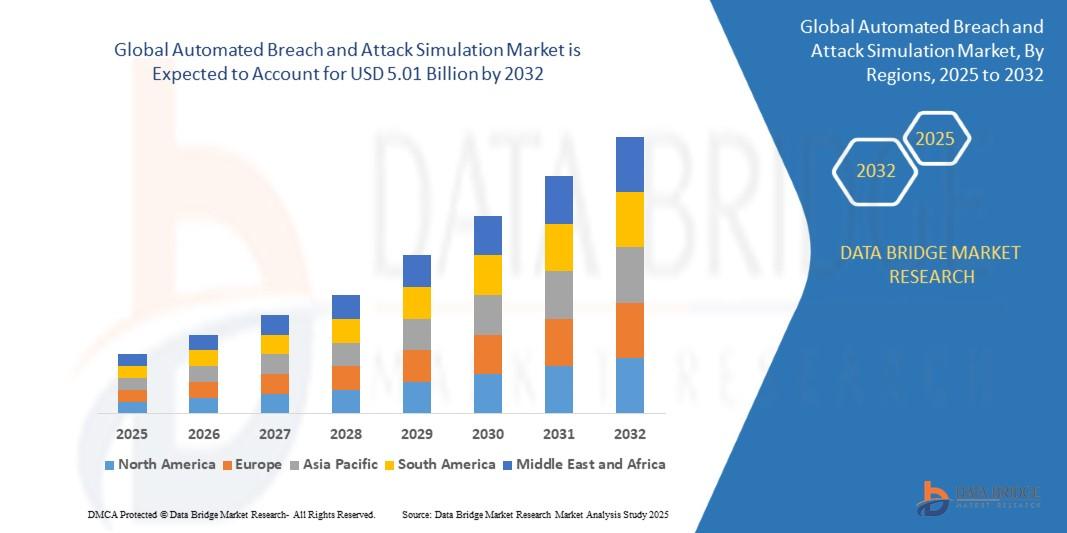

The integration of blockchain networks, tokenized assets, and crypto wallet platforms is reshaping financial service delivery globally. North America and Europe are leading in Web3 adoption due to robust technology infrastructure and regulatory frameworks, while Asia-Pacific shows significant growth potential fueled by fintech innovation and digital payment adoption. These regions benefit from the synergy of emerging hardware solutions and digital finance platforms to enhance security and performance.

Competitive Landscape and Future Outlook

Financial institutions, fintech startups, and blockchain platforms compete to offer innovative Web3-enabled solutions, including decentralized finance (DeFi) protocols, tokenized investment products, and automated smart contract banking. Strategic collaborations between traditional banks and technology providers are expected to accelerate the adoption of Web3 technologies. The industry is projected to grow as decentralized financial ecosystems, digital asset management, and blockchain-based banking solutions become increasingly mainstream.

FAQs

-

What are the key components of the Web3 in Financial Services Industry?

Key components include decentralized applications, blockchain adoption, tokenization, crypto wallets, and smart contract banking. -

How does Web3 improve financial services?

Web3 enhances transparency, security, efficiency, and user control, while reducing intermediaries and enabling programmable financial solutions. -

Which regions are leading in Web3 adoption for financial services?

North America and Europe are leading, with Asia-Pacific showing rapid growth driven by fintech innovation and digital finance adoption.➤➤Explore Market Research Future- Related Ongoing Coverage In Banking and Finance Industry: