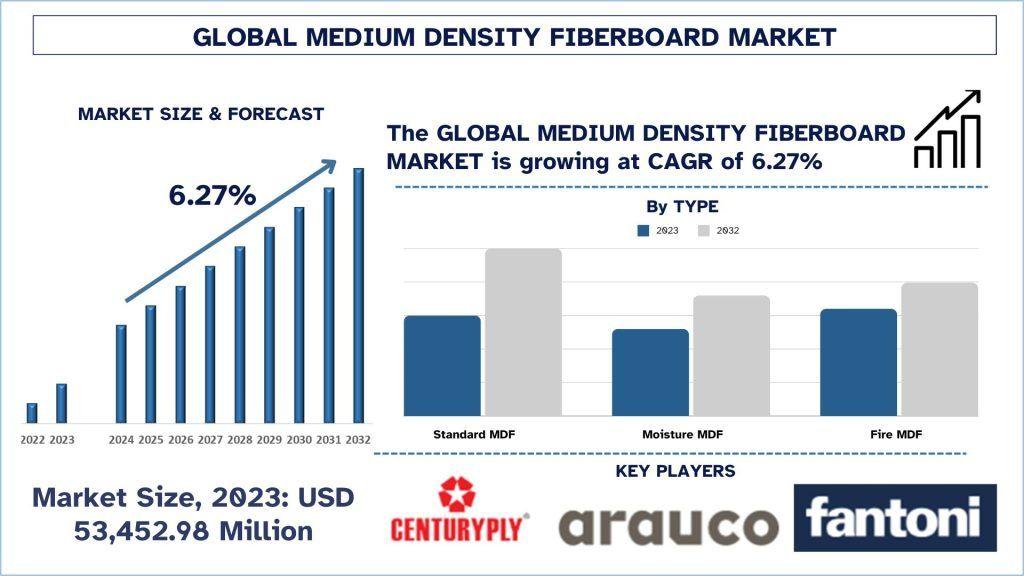

The Medium Density Fiberboard Market was valued at USD 53,452.98 million in 2023 and is expected to grow at a steady CAGR of around 6.27% during the forecast period (2024-2032),

The market is experiencing significant growth driven by increasing demand in the furniture, construction, and interior design sectors, coupled with technological advancements in manufacturing processes.

Market Dynamics

The MDF market continues to experience growth on account of the following factors. Firstly, the global population is increasing mainly due to the growth in urbanization hence the demand for furniture that is affordable and can easily last for a long time. More to this, machining of MDF is easier plus it is affordable making it suitable for mass production of furniture. For instance, IKEA, which is the world’s largest furniture retailer, has reported a 6.6% increase in their sales as compared to the previous year. Moreover, with the construction industry back on track after the outbreak of the Covid-19 pandemic. MDF requirement for use in flooring, wall paneling, and molding has increased, leading to more demand for MDF. For instance, in 2024, according to the report published by United States Census Bureau, the construction spending in during May 2024 was estimated at a seasonally adjusted annual rate of USD 2,139.8 billion, 0.1 percent (±1.0 percent) below the revised April estimate of USD 2,142.1 billion. The May figure is 6.4 percent (±1.6 percent) above the May 2023 estimate of USD 2,011.8 billion. During the first five months of this year, construction spending amounted to USD 836.3 billion, 8.8 percent (±1.2 percent) above the USD 768.6 billion for the same period in 2023.

Besides these, there are other factors that have impacted the advancement in MDF production such as increasing concern on the use of sustainable and environmentally friendly products. In September 2023, Egger Group launched the bio-based MDF line which uses up to 30% of renewable materials in view of growing environmental concerns regarding construction materials.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/medium-density-fiberboard-market?popup=report-enquiry

Sector Specific Growth

Furniture Sector: The furniture sector remains the largest consumer of MDF, driven by the booming e-commerce furniture market and the trend towards modular, customizable furniture designs. The furniture industry itself seeing a meteoric growth in the last couple of years and is expected to have the same efficacy in the forecasted period, due to the growing demand for modular furniture for living and bedrooms leads to increased adoption of medium density fiberboard. For instance, in 2023, according to U.S. Census Bureau, the furniture and home furnishing sales peaked in January 2023, with at almost USD 13 billion.

Construction and Flooring: The construction and flooring segment have been significant drivers of MFD demand, with the recent developments. The growing demand for sustainable building practices has been a forefront for the adoption of medium density fiberboard. Medium density fiberboard is often made from recycled wood fibers, which helps in earning points for recycled content under the MR category. Using materials with recycled content reduces the demand for virgin materials and decreases waste. MDF products that meet low-emission standards for formaldehyde and other volatile organic compounds (VOCs) can contribute to the low-emitting materials credit. This enhances indoor air quality by minimizing the release of harmful pollutants. For instance, in 2024, China topped the top 10 rankings for 2023 with over 24.53 million GSM certified followed by Canada with 7.9 million GSM. India retained its third spot on U.S. Green Building Council’s (USGBC) annual list of Top 10 Countries and Regions for LEED (Leadership in Energy and Environmental Design) in 2023. 248 projects, across both buildings and spaces, were certified for LEED in the country covering 7.2 million gross square meters (GSM). As the demand for green buildings continues to grow, the use of sustainable materials like MDF will become increasingly important in meeting environmental standards and achieving LEED certification.

Click here to view the Report Description & TOC: https://univdatos.com/reports/medium-density-fiberboard-market

Technological Advancements Drives the Medium Density Fiberboard

The market is experiencing rapid technological developments and significant efforts from top industry players in researching new and environmentally friendly production methods. Siempelkamp, a leading manufacturer of MDF production equipment, unveiled a new generation of continuous press technology that reduces energy consumption by up to 25% while improving board quality. Additionally, advancements in surface treatments and finishes are expanding MDF applications. Kronospan, one of the world's largest MDF manufacturers, introduced a new line of water-resistant MDF, targeting the kitchen and bathroom furniture markets. This innovation is expected to open new opportunities for MDF in moisture-prone environments. Additionally, the development of bio-based adhesives for MDF production is a notable trend. These adhesives reduce greenhouse gas emissions and reliance on fossil fuels. Huntsman Corporation's announcement of a new bio-based adhesive highlights this shift towards sustainable manufacturing processes. Furthermore, companies around the world are increasing their production expansion to meet the growing demand of the furniture, construction, and interior decorating industries. For instance, in September 2022, ARAUCO, a major manufacturer of plywood, approved the construction of a new MDF line in Zitácuaro, Mexico. The project considers an estimated investment of USD 235 million and incorporates leading edge operational, environmental and safety technology. The project is expected to begin operating during the second quarter of 2025, and this project is expected to add about 300,000 cubic meters of MDF production per year.

Conclusion:

With a rising trend towards the usage of Medium Density Fiberboard across numerous industries, innovative product development, and a shift towards more environmentally friendly products, the Medium Density Fiberboard market has a strong prospect of growing significantly in today’s global economy. Anticipating further advancement of manufacturing technologies, as well as their increased capacities to produce beyond the necessities, analysts currently predict that the market will become more concentrated and will expand geographically. Consumers’ preferences, regulatory frameworks, and the environment have always been dynamic, the future of the industry will largely depend on its capacity to Gear to these changes. Owing to constant emergence of new technologies, enhancement of product quality, and application in sustainability field, and expansion of its usage in furniture, constructions, and interior design industries, Medium Density Fiberboard is expected to remain among the most important materials used in the near future.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2024−2032.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis by Type and by Application.

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Contact Us:

UnivDatos

Email: contact@univdatos.com

Contact no: +1 978 7330253

Website: www.univdatos.com

Linked In: https://www.linkedin.com/company/univ-datos/