Market Overview

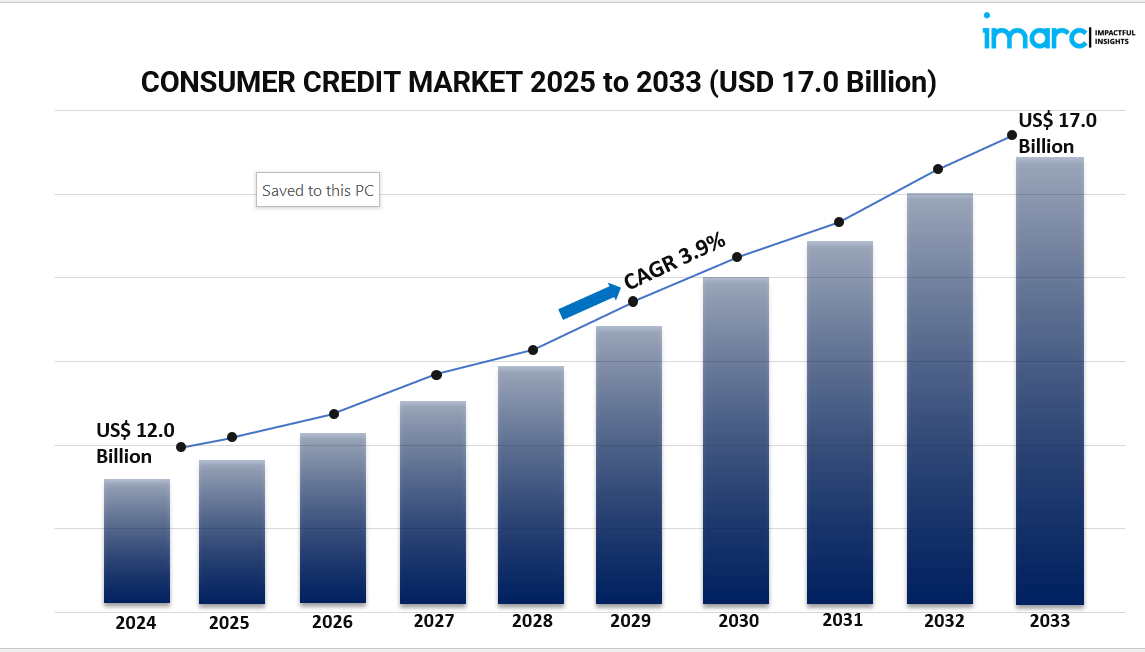

The global consumer credit market was valued at USD 12.0 Billion in 2024 and is projected to reach USD 17.0 Billion by 2033, growing at a CAGR of 3.9% during the forecast period of 2025-2033. North America dominates with over 35% market share. Key drivers include rising consumer economic conditions, growth of MSMEs in developing countries, financial management service prevalence, and digital financial service transformation. For details, see Consumer Credit Market

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Consumer Credit Market Key Takeaways

- The global consumer credit market size was USD 12.0 Billion in 2024.

- The market is estimated to grow at a CAGR of 3.9% from 2025 to 2033.

- The forecast period for the market analysis is 2025-2033.

- North America dominated the market with over 35% market share in 2024.

- Growing middle-class populations and digital transformation in financial services drive market growth.

- Increasing adoption of credit products like BNPL, credit cards, and personal loans supports expansion.

- Financial inclusion initiatives target rural and underserved areas, enhancing market penetration.

Sample Request Link: https://www.imarcgroup.com/consumer-credit-market/requestsample

Market Growth Factors

The growth of the global consumer credit market is stimulated by economic growth, urbanization, and the digital transformation of financial services. Expanding middle-class populations in emerging markets drive demand for credit products that support higher standards of living. Innovations such as AI-driven credit scoring and seamless digital platforms have enhanced accessibility and enabled underserved populations to participate in formal credit systems. Buy Now, Pay Later (BNPL) services have diversified credit offerings, for example, Visa's Flexible Credential launched with the Affirm Card in November 2024, improving payment flexibility. Governments and financial institutions emphasize financial inclusion through policies expanding credit access in rural and remote areas. Mobile banking and digital payment integration have accelerated market growth. Moreover, changing consumer tastes toward customized financial products prompt credit providers to offer data-backed bespoke solutions, supporting innovation and regional competition.

Growth of micro, small, and medium enterprises (MSMEs) especially in developing nations, positively impacts market growth. Banks and financial institutions invest in MSMEs to minimize credit gaps with local vendors. Microbusinesses require credit for operational expenses and expansion. India's MSMEs generate 120 million jobs and contribute about 33% to the GDP. The startup ecosystem in India is rapidly growing, with 10,000 startups sanctioned in 156 days compared to 808 days previously, with Tier-2 and Tier-3 cities contributing 49%. Similarly, 92% of US businesses are microbusinesses. This expansion drives demand for consumer credit services.

Digitalization in consumer credit has transformed lending landscapes. The rapid adoption of digitization in banking, financial services, and insurance boosts market growth. SMEs spend substantial time and resources on banking, fostering digital behavior. The Reserve Bank of India formed a working group on digital credit regulation in January 2023. Integration of technologies including AI, machine learning, and cloud computing aids credit scoring, pricing, capital management, and risk minimization. Social media platforms enhance market connectivity, trust, and engagement, with banks like Bank of America, Citibank, Varo, Current, and Chase actively leveraging Instagram to promote credit services. Mobile-only banks such as kakaobank have rapidly gained millions of subscribers, demonstrating digital credit adoption.

Market Segmentation

Analysis by Credit Type:

- Non-revolving Credits are the largest segment in 2024, involving fixed loan amounts repaid over time. Growth is driven by auto and education loans, with vehicle loans in India rising 137% over three years and US monthly new auto loans averaging USD 55.0 Billion in late 2023.

Analysis by Service Type:

- Credit Services lead the market in 2024, covering loans and credit-related information. Examples include 9.43 million people with loans in Great Britain (2020) and 58% of American adults aged 18-29 having student loan debt. In India, 67% rely on personal loans.

Analysis by Issuer:

- Banks and Finance Companies lead in 2024, offering financial services such as lending, borrowing, and investment facilitation, supporting economic activity domestically and internationally.

Analysis by Payment Method:

- Debit Card holds about 60.0% market share in 2024. It facilitates EMI payments with low interest rates and features such as HDFC Bank's EASYEMI, usable for online and offline purchases. Debit cards have lower maintenance fees than credit cards.

Regional Insights

North America dominates the consumer credit market, holding over 35% share in 2024. The region's growth is attributed to rising consumer credit adoption among small and medium enterprises and personal loan uptake. Total loans in the United States reached USD 12,305.379 billion as of March 2024. Well-established banks like Citi Bank, Bank of America, and Goldman Sachs contribute to a positive market outlook, with continued investment and expansion. In January 2024, Citigroup announced plans to expand its investment banking unit in China. This leadership supports steady market growth and innovation.

Recent Developments & News

- December 2024: Axis Bank launched 'Primus,' a super-premium credit card with Visa targeting ultra-high-net-worth individuals in India.

- December 2024: Times Internet and ICICI Bank introduced the metal 'Times Black ICICI Bank Credit Card' offering airport lounge access and elite event privileges.

- October 2024: Barclays U.S. Consumer Bank partnered with General Motors to exclusively issue GM Rewards Mastercard and GM Business Mastercard in the US, enhancing loyalty.

- September 2024: CARD91 unveiled its 3-in-1 card platform integrating ID, access, and prepaid cards for corporate and student needs.

- August 2024: Visa highlighted payment innovations at Global Fintech Fest 2024, including HDFC Bank's POS, Paytm NFC Card Soundbox, and Axis Bank Neo app.

Key Players

- Bank of America

- Barclays

- BNP Paribas

- China Construction Bank

- Citigroup

- Deutsche Bank

- HSBC

- Industrial and Commercial Bank of China (ICBC)

- JPMorgan Chase

- Mitsubishi UFJ Financial

- Wells Fargo

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for customization: https://www.imarcgroup.com/request?type=report&id=2291&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201-971-6302